Deposit Methods on Pocket Option for Indian Traders

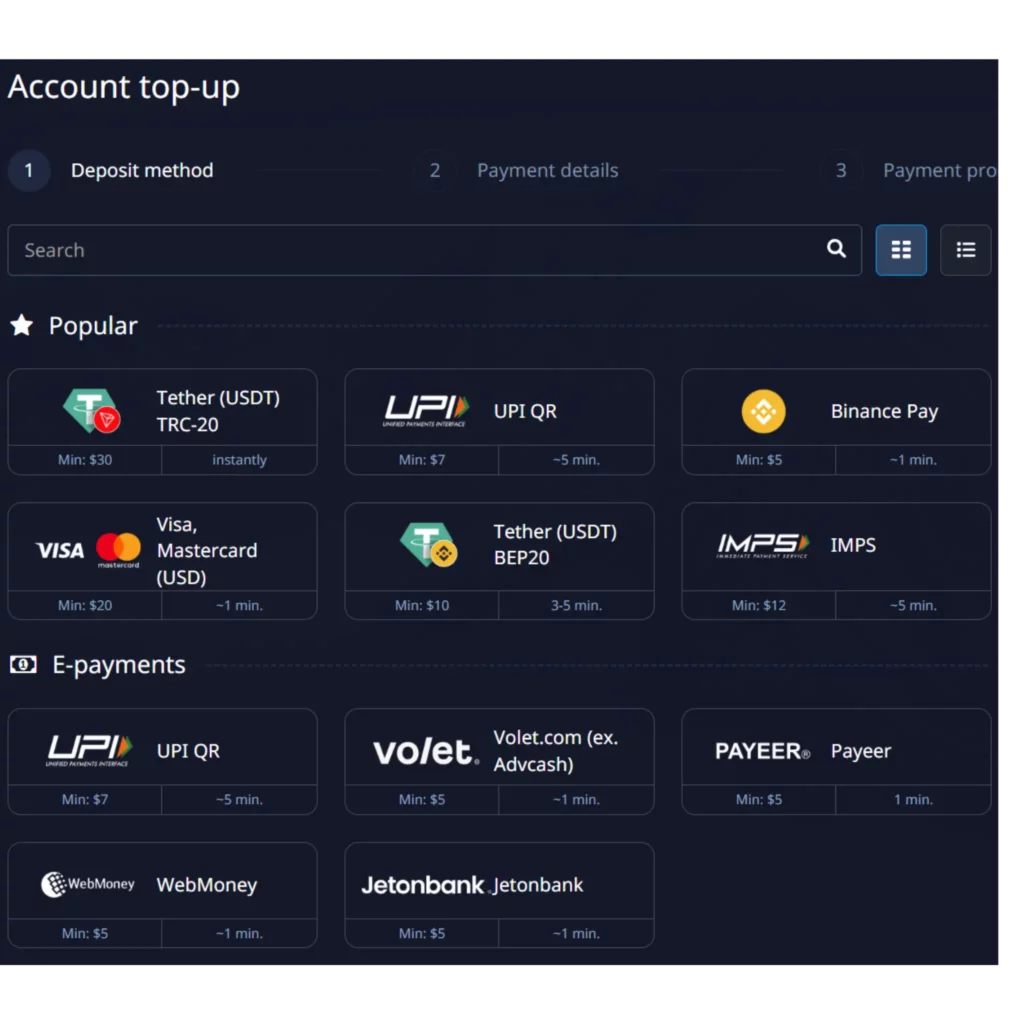

Pocket Option offers a wide range of deposit methods tailored to meet the needs of traders in India. To check available options, visit the “Deposit” section at the top of the platform. This will display all supported payment methods, along with the minimum deposit amount shown in the lower-left corner of each option.

Deposit Methods Page Contents

Available Deposit Methods on Pocket Option for Indian Traders

Indian traders can fund their accounts using various payment methods, including:

- UPI (Unified Payments Interface) – Convenient and widely used in India.

- Bank Transfers – Secure method for direct transactions.

- Credit & Debit Cards – Visa, Mastercard, and RuPay cards are supported.

- E-wallets – Neteller, Skrill, Paytm, PhonePe, and other local payment systems.

- Cryptocurrencies – Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and other crypto options.

The availability of payment options may vary depending on the trader’s location. Most deposits are processed instantly, but some methods, such as bank transfers or cryptocurrency transactions, may require additional processing time.

To ensure a smooth deposit process, always use a payment method registered in your name. Deposits from third-party accounts may cause delays or lead to verification requests. In the event that problems occur, Pocket Option’s customer service is accessible around-the-clock to help with deposit-related inquiries and guarantee Indian traders a hassle-free experience.

Pocket Option Minimum Deposit: A Handbook for Indian Traders

Traders can begin trading with a small amount because to Pocket Option’s low entrance hurdle. Generally, Indian traders can start trading with as low as $5, while the minimum deposit amount varies according on the payment method selected. Because of this, Pocket Option is a platform that both novice and seasoned traders may use.

How Can I Use Pocket Option to Make a Minimum Deposit?

Depositing funds on Pocket Option is a straightforward process. Log in to your account and click on the “Deposit” button at the top of the screen. You will be directed to the payment options page, where you can choose from various deposit methods. Select your preferred method, enter the deposit amount (ensuring it meets or exceeds the minimum requirement), and confirm the transaction. Deposits are typically processed instantly, but some methods may take longer.

Special Registration Offer

With Pocket Option, take the first step toward profitable trading. Use a promo code to register now and get exclusive advantages designed just for Indian traders.

Don’t miss this opportunity to join a platform trusted by thousands of traders worldwide. Sign up now and start your trading journey with a reliable partner that prioritizes security, success, and customer satisfaction.

We’re more than just a trading platform – we’re your gateway to financial growth. Click here to register now!

Frequently Asked Questions (FAQ) – Pocket Option Deposit Methods in India

What is India’s minimum Pocket Option deposit amount?

For Indian traders, the minimum deposit on Pocket Option is $5, or roughly ₹400. Depending on the deposit method selected, the needed amount may change.

Which deposit options are available to traders in India?

UPI (Google Pay, Paytm, PhonePe, BHIM), bank transfers, Visa/Mastercard, RuPay cards, e-wallets (Neteller, Skrill), and cryptocurrencies (Bitcoin, Ethereum, Tether USDT, etc.) are various ways that Indian traders can deposit money.

How long does it take for my deposit to be credited?

Most deposits are processed instantly, especially when using UPI, e-wallets, or credit/debit cards. Bank transfers and cryptocurrency transactions may take longer, depending on the payment provider’s processing time.

Are there any deposit fees?

Pocket Option does not charge fees for deposits, but some payment providers may apply transaction charges. It’s best to check with your bank or e-wallet service before making a deposit.

Can I deposit funds using someone else’s bank account or card?

No, deposits must be made from an account registered in your name. Third-party deposits may be rejected and may require additional verification.

Why was my deposit delayed or not credited?

If your deposit was not processed immediately, possible reasons include bank processing delays, incorrect payment details, or verification issues. If the funds are not credited within the expected time, contact Pocket Option’s 24/7 customer support for assistance.

Can I make a deposit in Indian Rupees (INR)?

Yes, INR deposits made via regional payment channels like bank transfers and UPI are accepted by Pocket Option. Depending on the exchange rate in effect at the time of deposit, the sum will be converted to USD.

Is it safe to make a deposit on Pocket Option in India?

Yes, Pocket Option uses secure payment gateways and cutting-edge encryption to guarantee safe transactions. For further account protection, two-factor authentication (2FA) is also offered.